How Do I Find a Business for Sale in Boston Today?

Finding a business for sale in Boston has evolved. In 2026, the "Silver Tsunami" of retiring Baby Boomers has reached its peak, flooding the market with established companies. However, navigating this landscape requires more than a simple search engine; it requires a "Trusted Navigator" who understands the intersection of local economic shifts and national acquisition trends.

Whether you are an individual seeking the "proverbial needle in a haystack" or a strategic buyer pursuing a bolt-on acquisition, your journey to buying a business in Massachusetts starts with understanding the current climate.

1. The 2026 "Silver Tsunami": A Buyer’s Opportunity

The primary driver of the Boston market today is the mass exit of owners who have spent 30+ years building their legacies. These aren't just "listings"; they are life’s works. Because many of these owners lack a formal exit plan, the opportunity for an entrepreneurial-minded buyer to step in and provide a dignified exit is higher than ever.

2. Navigating the "Millionaire’s Tax" and MA Nexus Laws

In 2026, the technicalities of the Massachusetts "Millionaire’s Tax" (the 4% surtax on income over $1M) heavily influence deal structures. Savvy buyers and sellers are now utilizing Strategic Planning to structure payouts—such as installment sales—to keep liquidity events below the threshold. Furthermore, we help you evaluate if a target business meets the $500,000 economic nexus threshold, ensuring there are no surprise out-of-state tax liabilities post-closing.

3. Why Confidentiality is the "Gold Standard"

The best businesses for sale in Boston are often the ones you can't find on public boards. To protect employees and customer relationships, high-value opportunities are kept behind a wall of confidentiality. At FCBB, we ensure that no names or addresses are disclosed until a buyer is pre-qualified with an NDA and Proof of Funds. This protects the integrity of the business you are looking to acquire.

4. The Importance of a Professional Market Price Analysis

Don't rely on "rules of thumb" or generic multiples. In the current market, valuation is both an art and a science. We look specifically at EBITDA multiples in Boston, factoring in the Single Sales Factor Apportionment shifts for 2025. A proper Market Price Analysis ensures you are paying a fair price based on real-world data, not just a seller’s hope.

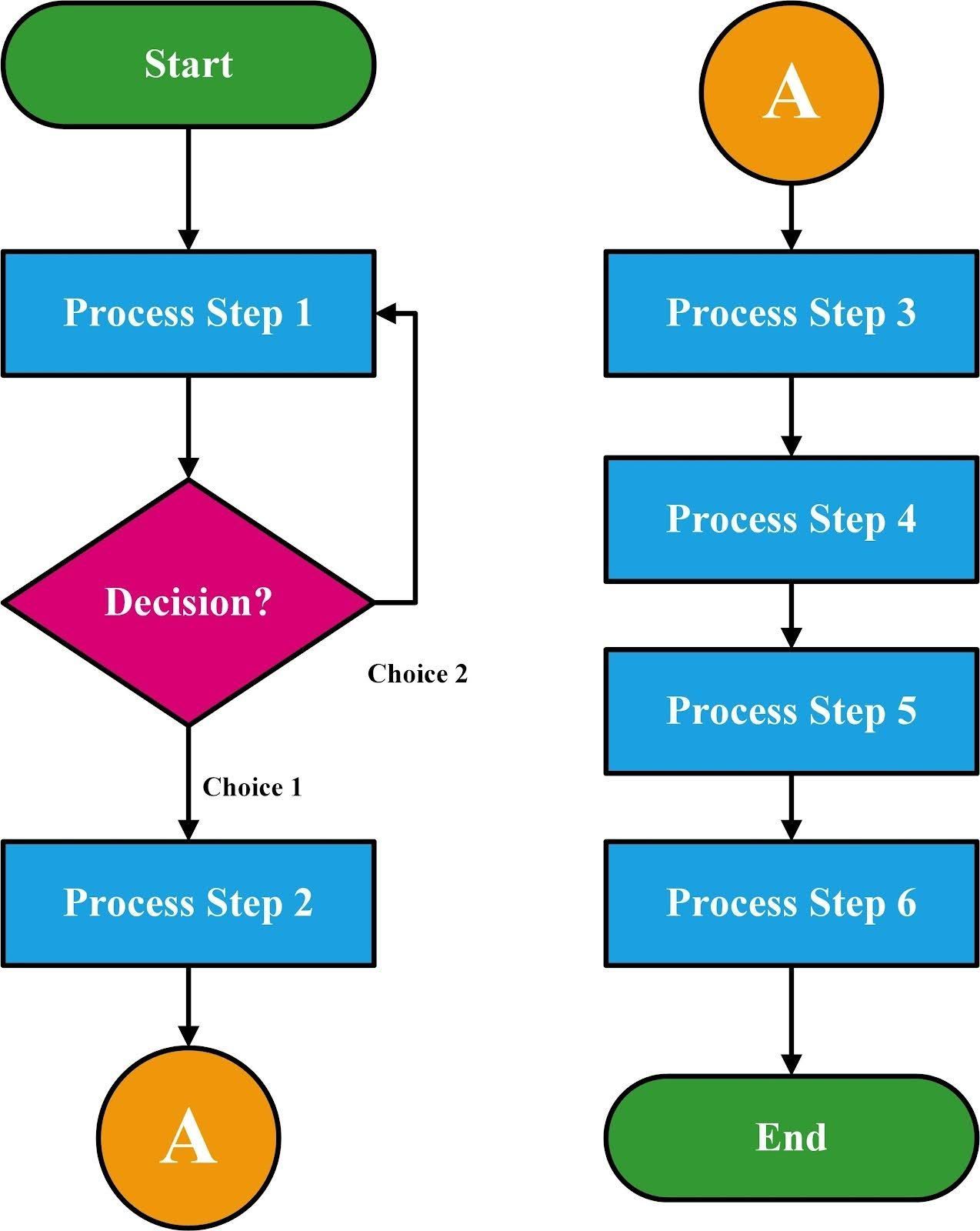

5. Moving from LOI to PSA: The Technical Bridge

The "Black Box" of due diligence is where most deals fail. As your intermediary, we guide you through the transition from the Letter of Intent (LOI) to the Purchase and Sale Agreement (PSA). We manage the legal and financial scrutiny, ensuring that the "8 Stages" of the Synergy Process are followed so you never have to walk the path alone.

6. Financing Your Acquisition in the Current Economy

Securing funding for a business for sale in Boston requires a clean presentation of "recast" financials. By removing non-operating expenses and one-time costs, we help buyers present a clear picture of the business’s true earning power to SBA lenders or private investors, streamlining the path to the closing table.

Frequently Asked Questions

How long does it typically take to buy a business in Massachusetts?

The process generally takes 6 to 9 months, depending on the complexity of due diligence and the speed of financing.

What is the "Millionaire's Tax," and does it affect me?

This is a 4% surtax on annual taxable income over $1 million in MA. If the business sale results in a large capital gain, it may trigger this tax, making deal structuring critical.

Do I need a broker to buy a business?

While not required, a professional advisor provides "Transactional Guidance" and access to unlisted inventory that you won't find on public marketplaces.

First Choice Business Brokers: The World’s Authority in Business Sales

Navigating the Boston business market in 2026 requires more than just capital; it requires a methodical approach and a deep understanding of local regulatory shifts. By focusing on positioning, strategic planning, and strict confidentiality, you can transition from a seeker to a successful business owner.

Ready to Find Your Next Opportunity?

Don't go into the "Black Box" of business buying alone. Let our expert advisors provide the roadmap you need.

Disclaimer: The information provided in this blog is for educational purposes only and does not constitute legal, tax, or financial advice. Business transactions involve risk; always consult with a qualified legal or tax professional regarding your specific situation in Massachusetts.

First Choice Business Brokers Boston

📞 (857) 600-3660

🌐 https://boston.fcbb.com

📧 boston.fcbb.com